Visibility strategies on the Digital Shelf: How to monitor MSRP and protect brand integrity

In the dynamic

retail ecosystem, maintaining a balance between

online sales volume and healthy margins is a constant challenge. You've probably experienced this: you launch a premium product and, within hours, see prices on various marketplaces begin a downward trend, jeopardizing your business strategy and diminishing the perceived value for the consumer.

For e-commerce managers, the

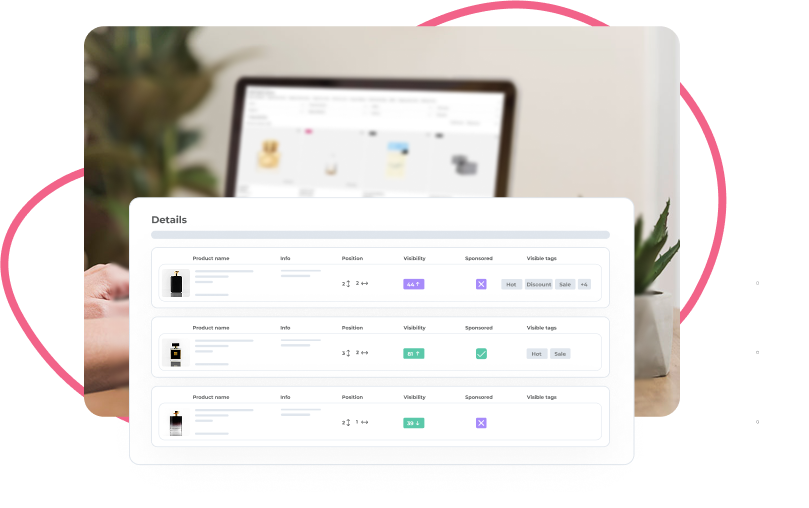

MSRP (Manufacturer's Suggested Retail Price) is the compass that guides brand positioning. However, in an increasingly fragmented environment, where each retailer or marketplace creates its own

digital shelf , ensuring price consistency and maintaining an optimized digital storefront requires advanced, data-driven monitoring with high precision.

What is MSRP

The

MSRP , known in Spain as

PVPR (Recommended Retail Price) , is the value that you, as a manufacturer or brand, suggest to distributors for the marketing of your products.

It is crucial to understand that the

MSRP is a strategic recommendation . According to

European Commission guidelines, resale price fixing (RPM) is illegal; brands can suggest prices, but cannot impose them or retaliate against those who do not follow them, as this restricts intra-brand competition (Source: European Commission Competition Policy, Regulation 2022/720). Therefore, the MSRP is not a legal requirement, but rather a tool to communicate value and prevent the trivialization of the product on the digital shelf.

Why MSRP matters in retail and online sales

Meeting MSRPs reflects the integrity and health of your brand.

Brand perception

Price is a critical quality indicator. If your products are constantly being aggressively discounted on unauthorized sites, the perception of exclusivity erodes. An

aligned MSRP across channels contributes to an integrated pricing strategy , preventing fluctuations that impact both margins and

perceived value within the digital shelf .

Effect on conversion and chronic discounts

When retailers enter a downward price spiral, it creates a "wait-and-see" effect among consumers. According to studies by

Deloitte , 76% of shoppers compare prices online before making a purchase (Source: Deloitte Consumer Review), meaning that an uncontrolled MSRP slows conversion to full-priced items and damages long-term profitability.

The challenges of MSRP in the era of online sales

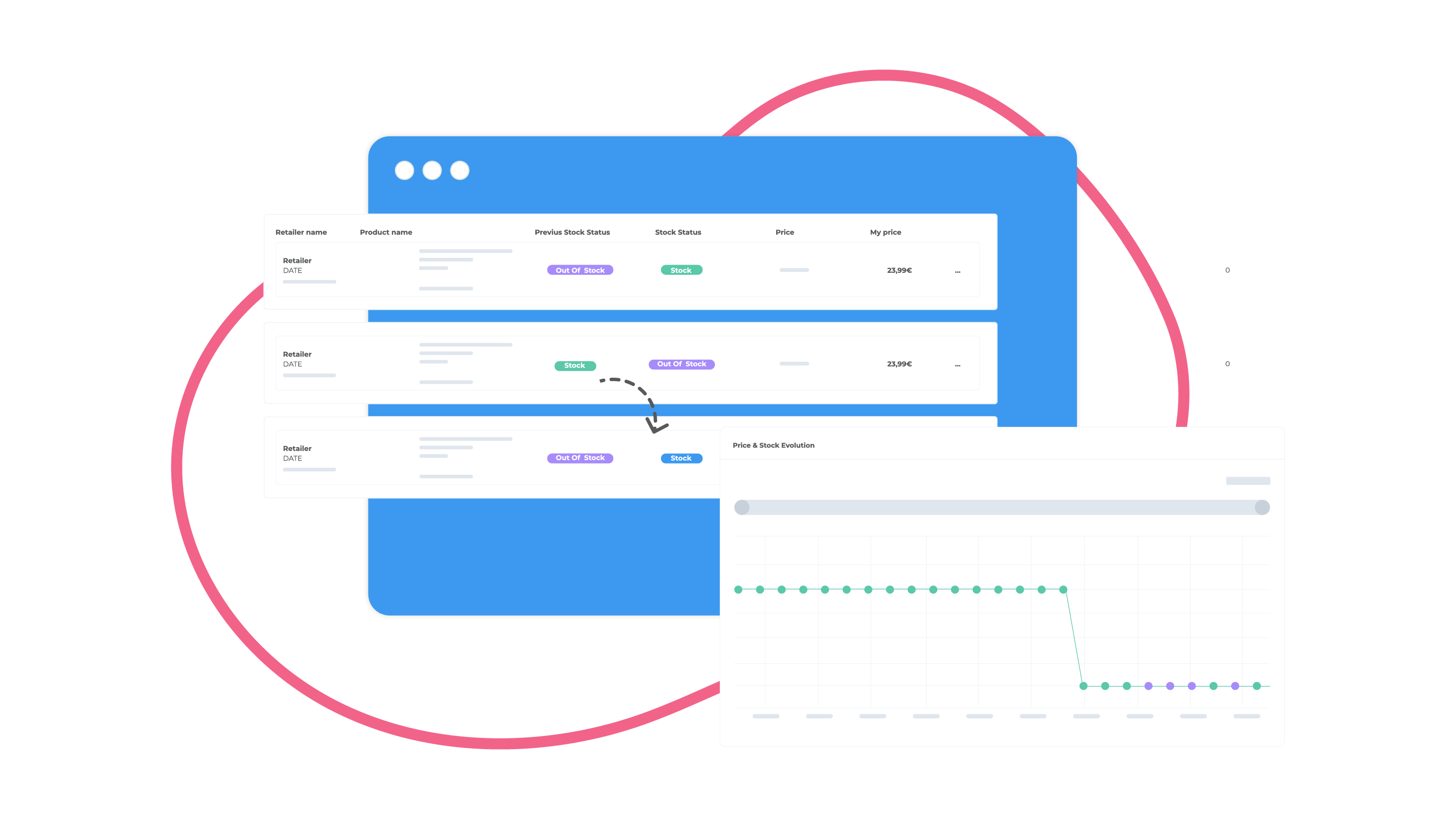

Monitoring

MSRP today requires going beyond simply observing numbers: it demands a data infrastructure capable of tracking thousands of SKUs in real time, identifying the exact origin of each fluctuation, and providing the traceability needed to understand how your brand's value shifts across multiple simultaneous channels.

- Multiplication of channels : The expansion of marketplaces and e-retailers has diversified sales outlets, increasing exposure opportunities, but also the sources of price deviations. This is especially true when unauthorized resellers or distributors are involved.

- Lack of visibility : Tracking hundreds of sites and marketplaces simultaneously to detect MSRP deviations is impossible without automation. The absence of comparable, real-time data prevents agile responses to channel adjustments.

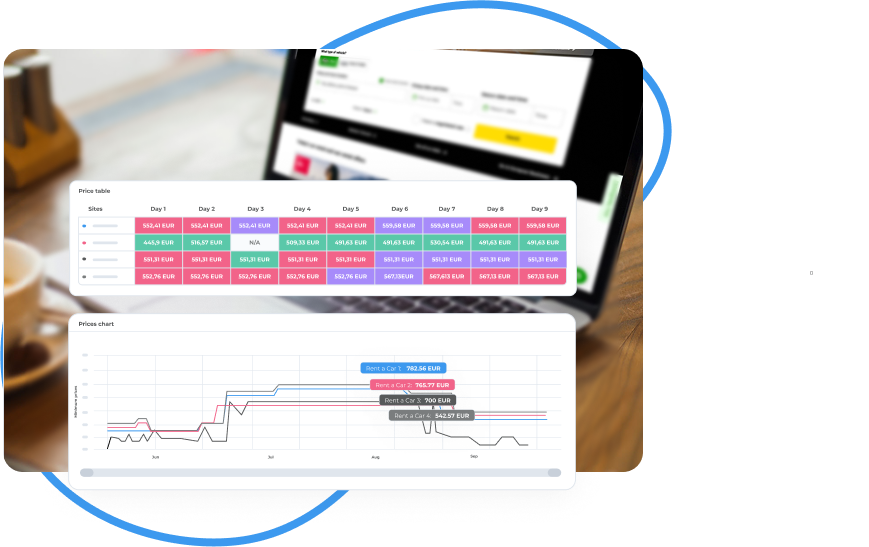

- Repricing algorithms : Many competitors use automated rules that change prices in a matter of minutes. When one seller adjusts prices by a few cents, the others react, leading to an erosion of margins and value positioning.

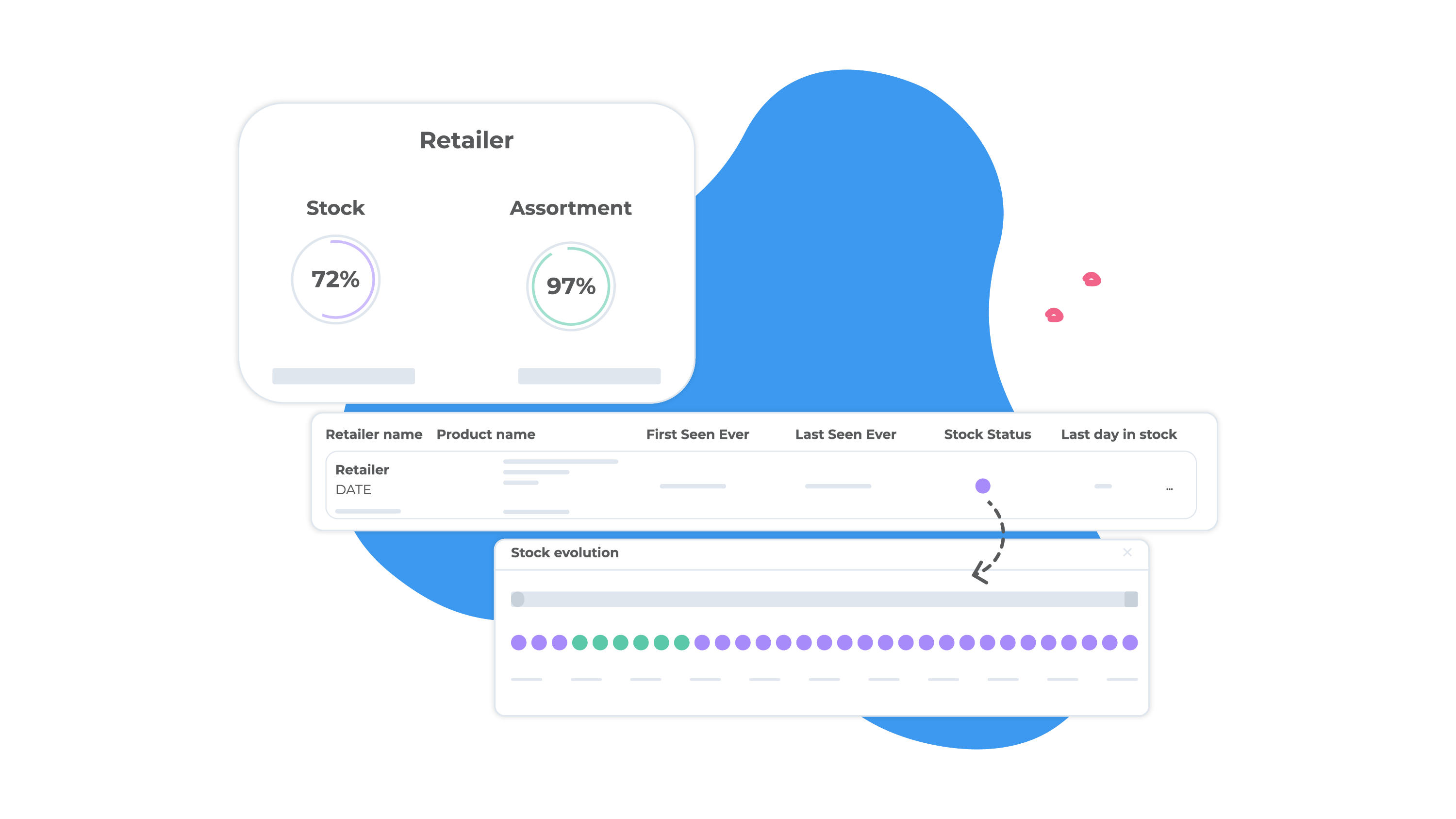

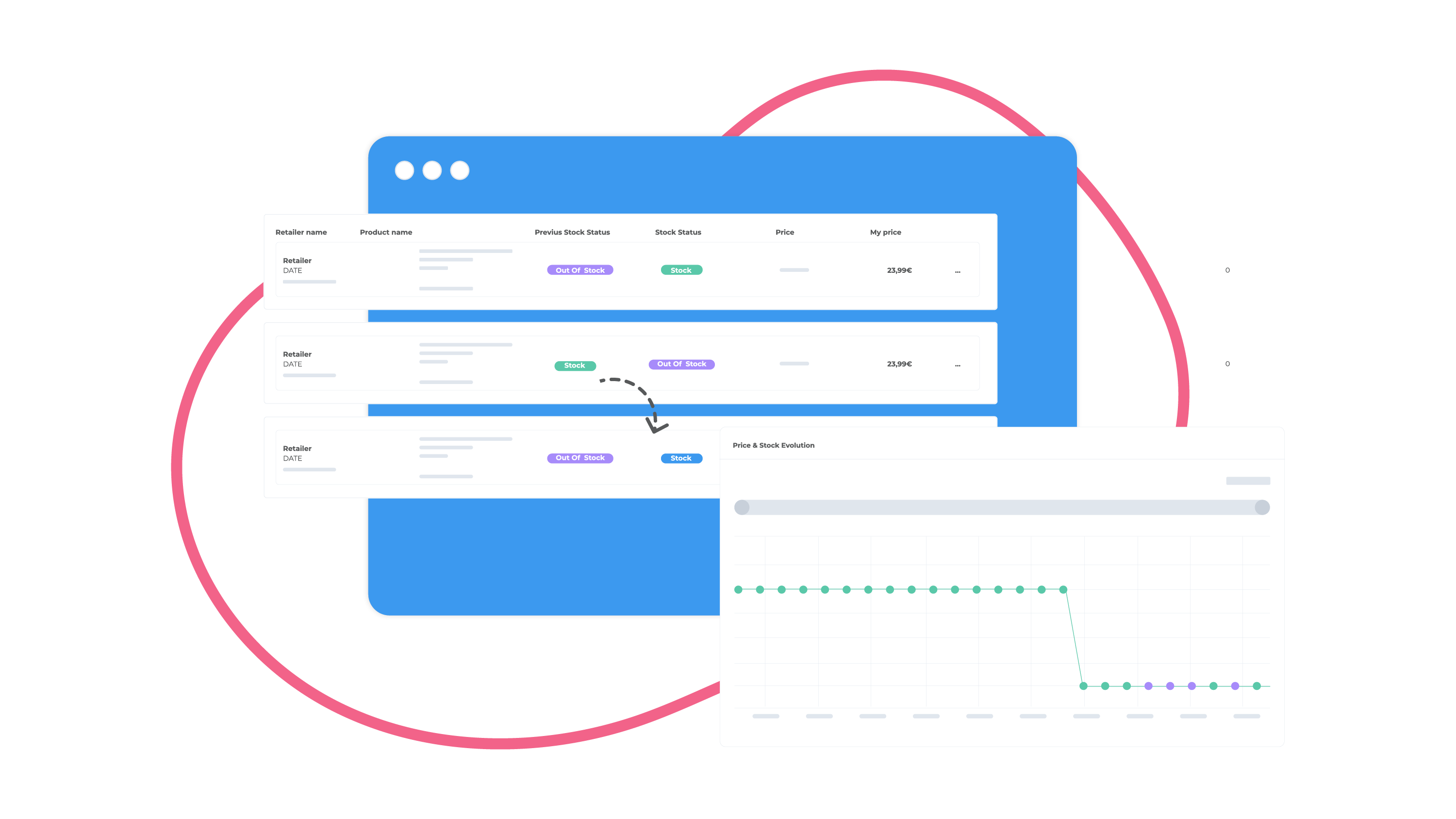

How to monitor MSRP compliance with DIP Insights

To regain visibility into what's happening with your pricing across all channels, you need

a solution that transforms data into proactive business intelligence .

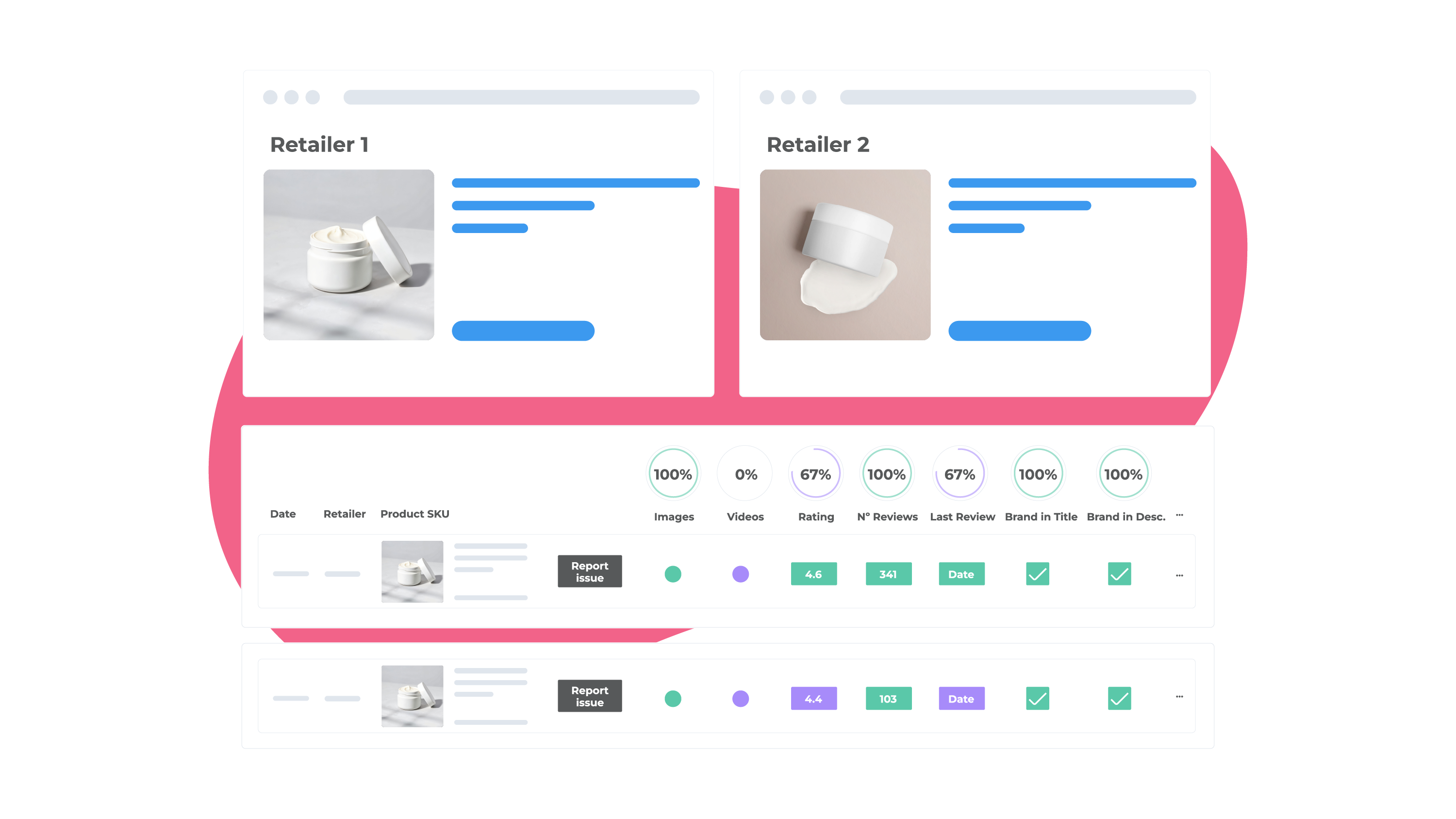

DIP Insights , Data Seekers' 360° platform, offers the comprehensive visibility that roles like Head of E-commerce or Pricing Manager require.

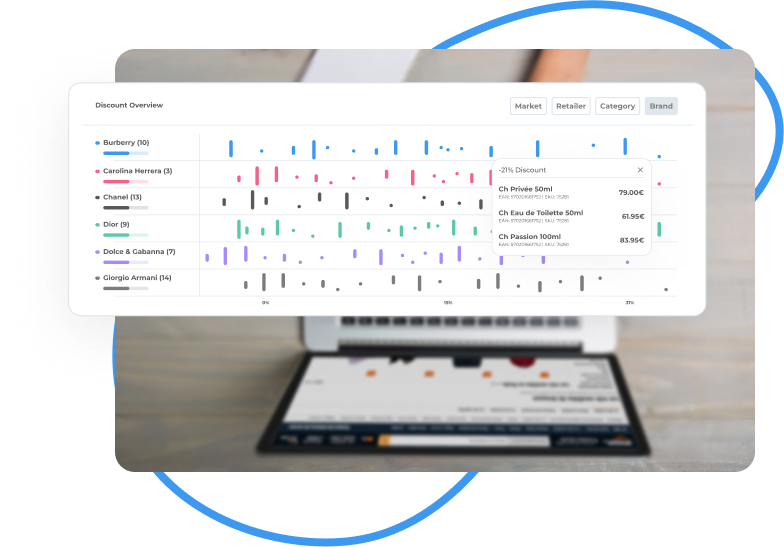

Dispersion and Positioning Analysis

Our technology allows you to perform a

Price Dispersion Analysis to quickly identify which retailers are deviating from the MSRP and by what percentage.

- Gap Identification : Detects who was the "first mover" in a price drop and who followed, making it easier to understand how the discount chain was generated in the channel.

- Global Coverage : We monitor any brand in any market and across multiple sites almost immediately, normalizing the data for reliable comparison between countries and channels.

Intelligent Alert System

Forget about reviewing data-heavy reports.

DIP Insights features a customized alert system, configured by business rules, product type, and recipient profile, that notifies you of any relevant price adjustments for your strategic products. This allows teams like

Digital Operations or Key Account Managers to act quickly to protect commercial agreements and brand positioning in every channel.

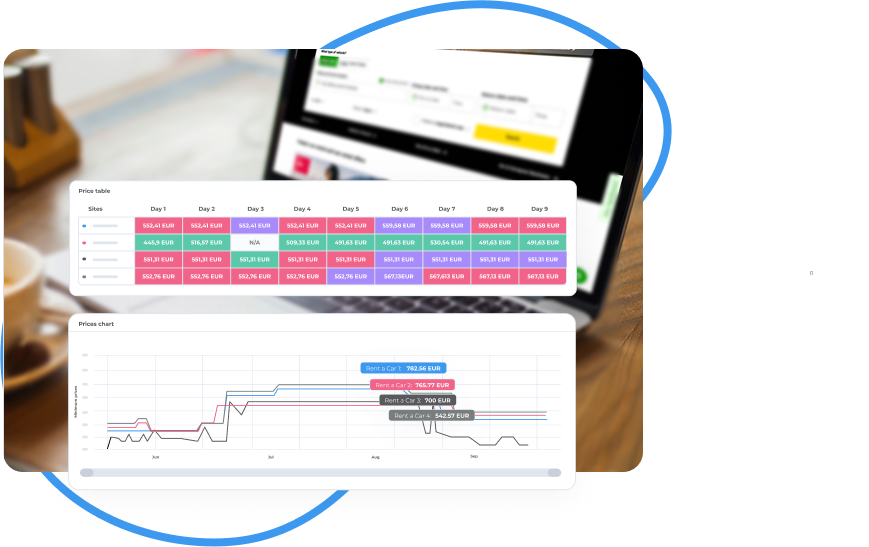

Negotiation strategy: From data to commercial action

Detecting the deviation is only the first step. The true ROI of

DIP Insights lies in transforming data into solid business arguments to negotiate with retailers and strengthen strategic relationships.

- Data-driven evidence : When meeting with a retailer, don't rely on assumptions. Present the pricing history and scatter map from DIP Insights to demonstrate how their discount policy is impacting your overall brand consistency and eroding perceived value.

- Identify the source of price drops : Often, a retailer lowers prices because another did so first. Our platform reveals who made the adjustment first. This objective evidence helps de-escalate tensions with your key distributors.

- Reward compliance with investment : Use banner visibility and Digital Shelf Score to incentivize retailers who respect MSRP, offering them greater support in campaigns or stock exclusivity.

"Whoever controls the data, controls the market." In a retail environment where the fastest wins, complete visibility into your pricing strategy is your ultimate competitive advantage.

Do you want to optimize your prices and maximize margins on the Digital Shelf? Request a personalized demo of DIP Insights today and discover how our 360° data intelligence can transform your operational profitability.